The Significance of the 2025 COLA Increase

The 2025 Social Security Cost-of-Living Adjustment (COLA) is a significant event for millions of Americans who rely on Social Security benefits. This increase will directly impact the financial well-being of seniors and retirees, and its implications extend beyond individual beneficiaries to the broader economic landscape.

The Impact on Social Security Beneficiaries

The COLA increase directly affects the purchasing power of Social Security beneficiaries. A higher COLA means that beneficiaries receive more money to cover the rising costs of goods and services. This increase is crucial for seniors, many of whom live on fixed incomes and are particularly vulnerable to inflation.

“The COLA increase helps to ensure that seniors can maintain their standard of living and afford the essentials they need, like food, housing, and healthcare.”

For example, a beneficiary receiving $1,500 per month in benefits would see an increase of $100 per month with a 6.6% COLA increase. This extra money can make a significant difference in their ability to meet their financial obligations and enjoy a comfortable retirement.

Future Projections and Considerations: 2025 Social Security Cola Increase

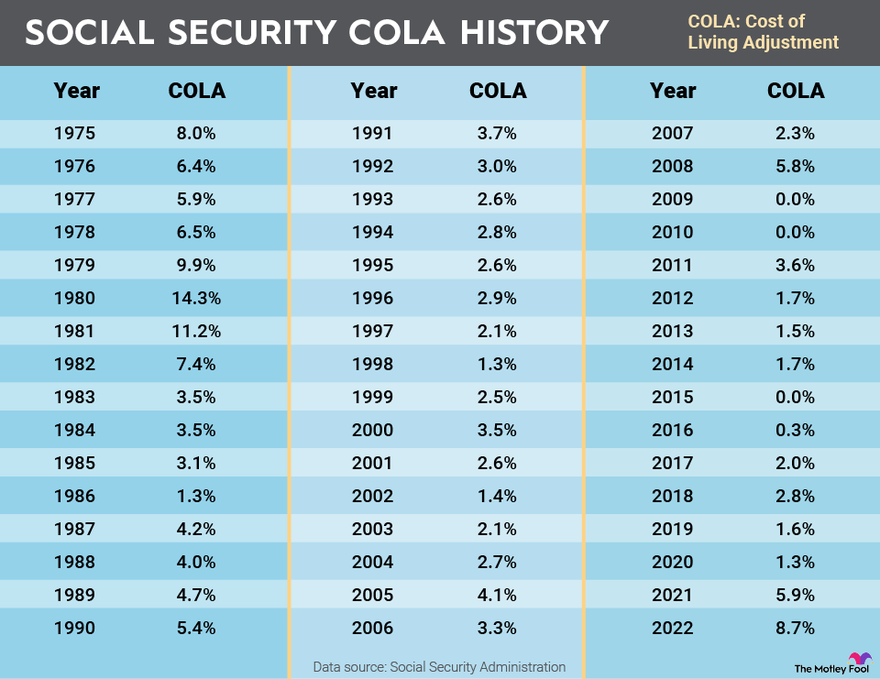

Predicting the future of Social Security COLA increases is a complex task, influenced by a variety of economic factors. While we can’t foresee the exact trajectory of these increases, analyzing historical trends and current economic conditions can provide insights into potential scenarios.

Factors Influencing Future COLA Increases

The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of inflation. Therefore, factors that impact inflation will also influence the COLA. Some key factors include:

- Economic Growth: A strong economy typically leads to higher inflation, which could result in larger COLA increases. For example, in 2022, the strong economic recovery following the pandemic led to a 5.9% COLA increase, the largest in decades.

- Energy Prices: Fluctuations in energy prices, particularly oil and gas, have a significant impact on inflation. For instance, the spike in energy prices in 2022 contributed to the high COLA increase that year.

- Interest Rates: The Federal Reserve’s monetary policy, including interest rate adjustments, can influence inflation and, consequently, COLA increases. Higher interest rates can help curb inflation, potentially leading to smaller COLA increases.

- Supply Chain Disruptions: Global supply chain disruptions can lead to shortages and price increases, contributing to inflation and potentially higher COLA increases.

Projected COLA Increases for the Next Five Years, 2025 social security cola increase

The following table presents projected COLA increases for the next five years, considering three different economic scenarios:

| Year | Low Inflation Scenario (1-2% CPI-W Increase) | Moderate Inflation Scenario (2-3% CPI-W Increase) | High Inflation Scenario (3-4% CPI-W Increase) |

|---|---|---|---|

| 2026 | 1-2% | 2-3% | 3-4% |

| 2027 | 1-2% | 2-3% | 3-4% |

| 2028 | 1-2% | 2-3% | 3-4% |

| 2029 | 1-2% | 2-3% | 3-4% |

| 2030 | 1-2% | 2-3% | 3-4% |

Note: These projections are based on current economic conditions and are subject to change. Actual COLA increases may vary depending on future economic developments.

2025 social security cola increase – The 2025 Social Security cost-of-living adjustment (COLA) is a crucial lifeline for millions of Americans, providing a much-needed boost to their income. However, it’s hard to focus on such financial matters when the world is consumed by the ongoing conflict in the Middle East, a conflict fueled by the complex history of the israel hamas leader and the political landscape of the region.

The COLA, while a necessary support, feels like a drop in the bucket compared to the weight of such international crises. It’s a reminder that even amidst global turmoil, the fight for economic security continues, making the 2025 COLA increase a beacon of hope for many.

The 2025 Social Security COLA increase is a topic on many minds, especially those who rely on those benefits for their well-being. It’s a time for careful planning and ensuring your finances are secure, just like protecting your valuable outdoor furniture with a durable cover like the hearth & garden sf40221 patio chair cover.

A little foresight and planning can go a long way, whether it’s securing your financial future or safeguarding your beloved outdoor seating.